- Replies 842

- Views 162.7k

- Created

- Last Reply

Top Posters In This Topic

-

Scotty 73 posts

-

snorbens_caleyman 61 posts

-

Charles Bannerman 47 posts

-

STFU 47 posts

Most Popular Posts

-

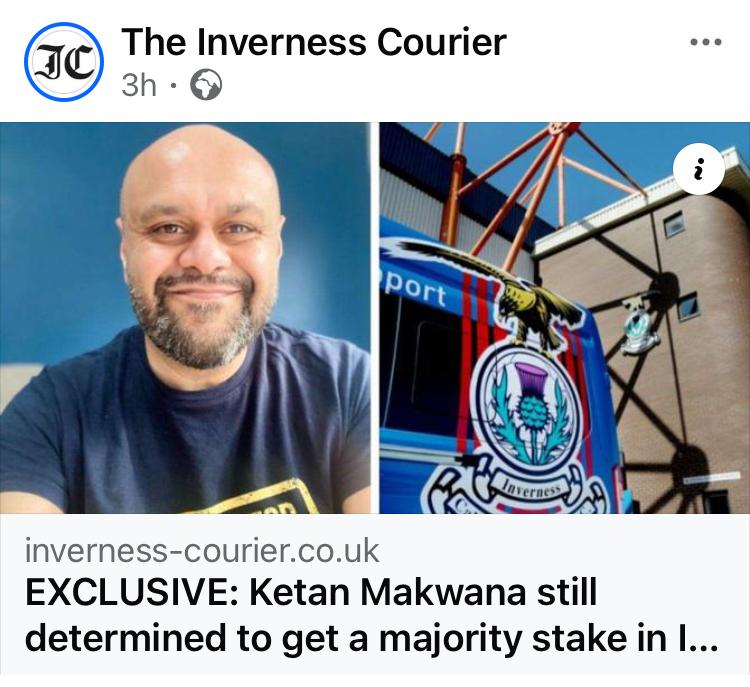

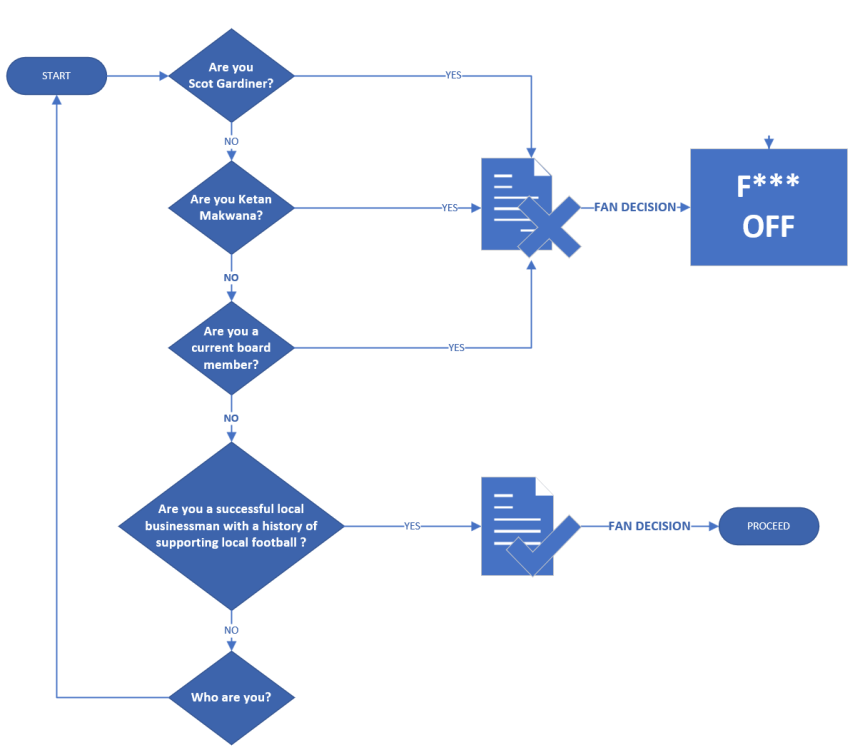

Still no accountability from our board though ... and more worryingly, still an undercurrent of thought that Makwana was a viable investor! As I make a personal comment on each of those quotes I

-

To be fair - the fans saw right through him immediately. We are all Marge Simpson (monorail reference). 100% agree. The current board should hang their heads in shame, not just over thi

-

They should replace the entire board - they all signed off on the Kelty move, they all signed off on the Makwana takeover, they all signed off on a massive deal for Ferguson, they all signed off on co

Featured Replies

Recently Browsing 0

- No registered users viewing this page.

First time poster guys - just seeing what's already out there in terms of the fans putting additional resources into the club . Having read through the forum a lot of people would be willing to buy season tickets and merchandise which is great . Unfortunately that's not going to be enough to keep the vultures at bay so just seeing if there are any fans initiatives already on the go which would put additional cash into the club . Much like what Hearts done in there time of need and Rangers with there fund . Just trying to think of a way to help .